Guanshanhu district provides loans to virus-hit enterprises

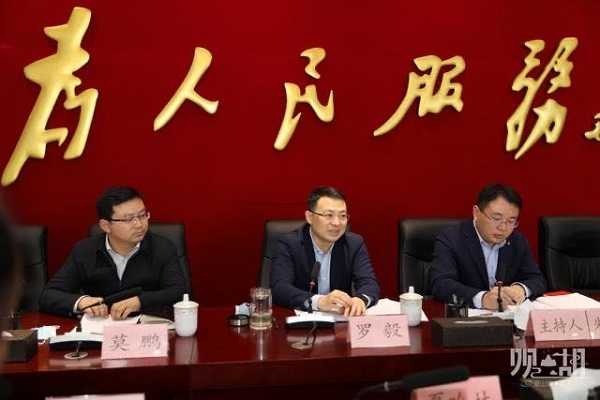

The signing ceremony of the industrial loan is held on March 26 in Guanshanhu district. [Photo/media center of Guanshanhu district in Guiyang]

The signing ceremony for an industrial loan, which is the first cooperative credit and loan project involving the government, an enterprise, and a bank, was held on March 26 in the Guanshanhu district of Guiyang, Southwest China's Guizhou province, according to local officials.

The project was reportedly signed by the Guanshanhu government, Guanshanhu District Guarantee Co Ltd, and the Guiyang branch of Industrial and Commercial Bank of China.

During the signing ceremony, the bank provided the first tranche of loans, totaling 18 million yuan ($2.54 million), to Guiyang Zhongwo Automobile Sales & Service Co Ltd and Guizhou Qianfeng Pipe Industry Co Ltd.

Guang Yanxia, financial director of Guiyang Zhongwo Automobile Sales & Service Co Ltd, said that the industrial loan provided working capital to the company, bringing more confidence in its future development.

"We not only received financial support from the bank, but also reduced the financing cost due to a lower loan interest rate, which dropped by 30 percent," said Xia Hao, general manager of Guizhou Qianfeng Pipe Industry Co Ltd.

He added that the company applied for an industrial loan totaling 9 million yuan and that the output value would increase by 50 million yuan.

Officials said that the district invested 20 million yuan as the initial fund to set up the industrial loan, and that the cooperative bank would provide financial support for micro, small, and medium-sized enterprises in the district according to a 1:10 ratio, aiming to shelter them from the negative economic impact of the novel coronavirus epidemic.

Enterprises applying for the industrial loan should meet the following conditions:

(1) The enterprise is established in Guanshanhu district in accordance with the law, and its products conform to the industrial policies of the country, province, city, and district.

(2) The enterprise has advantages in technologies, products, and development potential.

(3) The enterprise has positively contributed the industrial development of the district and does not have a bad credit record.

(4) The enterprise has the demand for working capital in production and operation.

(5) The enterprise has the ability to repay the principal and interest of the bank's credit funds on schedule and has a reliable source of repayment.

The upper limit of the industrial loan shall not exceed 10 million yuan. For high-quality enterprises who can provide credit enhancement measures, the limit can be increased to up to 30 million yuan with the agreement of the district government and the bank.

Officials said that they would further strengthen cooperation with enterprises and banks to help more enterprises enjoy the favorable policies, bolstering their ability for steady production and operation.

Zhao Yandi contributed to this story

Presented by China Daily.

黔ICP备05001922号-3